News

See our latest news, offers and articles below…

10 July, 2025

Au revoir Paris – the perfect farewell

The perfect farewell to your French exchange Optional Paris tour...

Read More

23 January, 2025

Experience USA + Grand Canyon!

Your USA exchange just got better: Explore the Grand Canyon...

Read More

9 October, 2024

Disconnect to Reconnect.

Get Engaged! On World Mental Health Day, October 10, Student...

Read More

29 February, 2024

Online Spanish Course 2024

Book your spot before our Spain August 2024 Academic Semester...

Read More

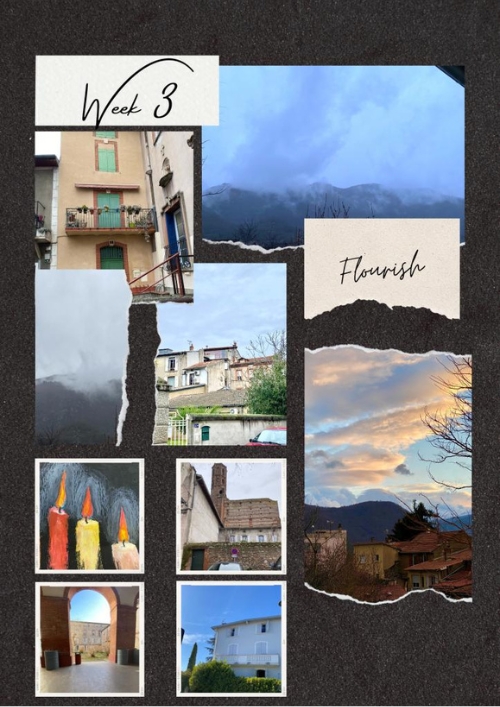

15 February, 2024

Student Update – Olly in France

Olly’s update after three weeks on exchange I feel like...

Read MorePlease follow our socials

Any questions?

Contact our team today

Student Exchange Australia New Zealand Ltd is a fully registered not-for-profit student exchange organisation in all Australian states and territories, ensuring compliance with both state legislation and national student exchange guidelines.